|

|

| Post Number: 281

|

was1

Group: Members

Posts: 1880

Joined: Apr. 2015

|

|

Posted on: Dec. 05 2017,8:47 am |

|

|

on state or federally funded projects, construction contractors are required by law to pay, at a minimum, those stated wages and fringe benefits to all workers on the project.

PREVAILING WAGE

Prevailing wage is the hourly rate, plus benefits, required by law to be paid for each trade or occupation while performing work on state-funded construction projects.

These projects can be highways, roads, wastewater treatment plants, JOBZ projects, public utilities, schools, parks and recreation improvements, or any other construction project funded in part or whole by state funds.

Minnesota's prevailing wage law (Minnesota Statutes 177.41 through 177.44) requires employees working on state-funded construction projects or other projects covered by law be paid wage rates comparable to wages paid for similar work in the area where the project is located.

|

|

|

|

| Post Number: 282

|

Glad I Left

Group: Members

Posts: 2303

Joined: Aug. 2005

|

|

Posted on: Dec. 05 2017,10:29 am |

|

|

Gotcha. Makes perfect sense. My late uncle worked hiway construction for years all over the country and there were certain states they hated going to because the paying wage was crap (in his words)

--------------

After we screw up health care reform, let's take on the initiative of unscrewing the education system (gov't education)

Tacitus: (c. 56 AD-c. 117) "The more corrupt the state, the more it legislates."

|

|

|

|

| Post Number: 283

|

Expatriate

Group: Members

Posts: 16764

Joined: Oct. 2004

|

|

Posted on: Dec. 05 2017,1:34 pm |

|

|

..

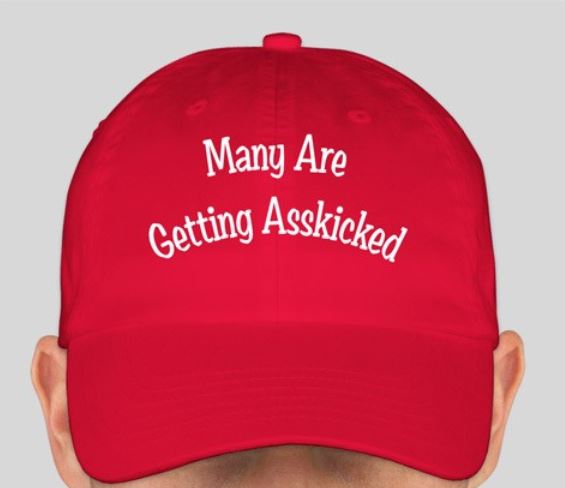

Attached Image

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

| Post Number: 284

|

Self-Banished

Group: Members

Posts: 22577

Joined: Feb. 2006

|

|

Posted on: Dec. 06 2017,4:58 am |

|

|

^^ yes, many nazis are.

--------------

Remember boys and girls, Remember boys and girls,

Don’t be a Dick  … …

Or a “Wayne”

|

|

|

|

| Post Number: 285

|

Expatriate

Group: Members

Posts: 16764

Joined: Oct. 2004

|

|

Posted on: Dec. 06 2017,5:22 am |

|

|

^^^idgit—they say ignorance is bliss—that's why you're so happy...

What the Experts Are Saying About Outsourcing and the GOP Tax Bill

AFL-CIO Staff

November 29, 2017

We know the Republican tax plan favors the super-rich and the wealthy corporations over working people. One of the many ways it will hurt working people is by setting up a territorial tax system, under which the active income of U.S. companies earned offshore will no longer be subject to U.S. taxes. This will further entice U.S. multinationals to shift their jobs and profits overseas.

But don't take our word for it. Here's what the experts are saying about outsourcing and the Republican tax bill:

Jared Bernstein, senior fellow, Center on Budget and Policy Priorities; former chief economist to Vice President Joe Biden:

“The Republican tax plan….is likely to lead to more outsourcing of U.S. jobs and a larger trade deficit. The tax plan moves to what’s called a territorial system of international taxation, which means the U.S. tax rate on the overseas earnings of U.S. foreign affiliates would become zero.”

Rebecca Kysar, professor of law, Brooklyn Law School:

“A pressing goal of tax reform is to reduce the incentives for companies to move their operations overseas. This bill does the opposite.”

Edward Kleinbard, former chief of staff, Joint Committee on Taxation; University of Southern California Gould School of Law:

“The administration’s tax cut proposal is coupled with a territorial tax system, which permanently exempts foreign income from taxation; this will further tilt the playing field in favor of foreign, rather than U.S., investment.”

Kimberly Clausing, professor of economics, Reed College:

The House and Senate Republican tax bills create a territorial tax system that “exempts foreign income from U.S. taxation. This tilts the playing field even further toward doing business abroad rather than at home, since there will always be countries with lower rates. A territorial system makes explicit and permanent the preference for foreign income over domestic income. It accelerates the profit shifting behind our corporate tax base erosion problem.”

Carl Levin, former senator:

“The House and Senate tax bills would be a monumental mistake for the country for many reasons, but one compelling reason is the disastrous way they treat foreign corporate profits and encourage companies to shift their operations and the economic benefits of intellectual property overseas.”

Richard Phillips, senior policy analyst, Institute on Taxation and Economic Policy:

“The most significant component of the Senate tax proposal on international taxes is moving to a territorial tax system, under which active income of U.S. companies earned offshore will no longer be subject to U.S. taxes. By doing this, the Senate tax plan moves in the opposite direction of real tax reform by substantially contracting the base of the U.S. corporate tax. According to the Joint Tax Committee, moving to the territorial tax system would cost $215 billion over the next decade. Exempting offshore income from U.S. taxation would encourage further profit shifting and would also create a tax incentive for corporations to move real operations and jobs offshore to take advantage of lower tax rates.”

Steven Rosenthal, senior fellow, Tax Policy Center; former counsel to Joint Tax Committee:

"The Tax Cut and Jobs Act (TCJA) that the Senate is debating this week would fundamentally change the way U.S.-based multinational corporations are taxed on their overseas income. But contrary to the claims of President Trump and congressional supporters, the new approach may still encourage U.S. companies to shift production overseas."

Reuven Avi-Yonah, professor of law, University of Michigan:

Certain “multinational corporations (for example, GE or Intel) will pay less because they have more tangible assets offshore. This creates an obvious incentive to move jobs (not just profits) offshore. Moreover, the proposal standing on its own would induce profit shifting because of the combination of the participation exemption and the lower rate (12.5% is less than 20%).”

Chuck Marr, director of Federal Tax Policy, Center on Budget and Policy Priorities:

“Another, less-noticed provision would permanently set an even lower tax rate for U.S.-based multinationals’ foreign profits by adopting a ‘territorial’ tax system, which would encourage firms to shift profits and investment offshore. As Senate Republican Ron Johnson said recently, ‘With a territorial system, there will be a real incentive to keep manufacturing overseas.’”

The FACT Coalition

“This bill would create significant new tax incentives to move U.S. jobs, profits, and operations overseas, while exploding the deficit. The bill’s complicated structure also creates multiple new loopholes to allow for expanded tax avoidance by large multinational companies at the expense of small businesses and wholly domestic companies.”

Victor Fleischer, tax professor, University of San Diego:

“The international provisions of the Senate tax bill are worse than I thought—a very nice gift to multinationals.”

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

| Post Number: 286

|

Self-Banished

Group: Members

Posts: 22577

Joined: Feb. 2006

|

|

Posted on: Dec. 06 2017,5:42 am |

|

|

AFL CIO? A new football league?

You should be happy this is going on, I'm posting less, too damned busy.

i

--------------

Remember boys and girls, Remember boys and girls,

Don’t be a Dick  … …

Or a “Wayne”

|

|

|

|

| Post Number: 287

|

Expatriate

Group: Members

Posts: 16764

Joined: Oct. 2004

|

|

Posted on: Dec. 06 2017,6:32 am |

|

|

US trade deficit rises to $48.7 billion on record imports

http://abcnews.go.com/Busines...1585695

financial discipline and responsibility hasn't been a strong suit of the populace of our country. The number living from paycheck to paycheck is unacceptable, the debt-load most of these people are carrying is unsustainable.

This pending tragedy is only exasperated by the multinational seeking ever cheaper labor offshore and selling those goods here. This in-turn puts downward pressure on wages when the American worker can least afford it..

we haven't really seen an increase in employment we've seen the boomers retiring. this trend will continue for some time.

you may be busy now but the big bust is coming...this isn't a good thing for any of US...

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

| Post Number: 288

|

Self-Banished

Group: Members

Posts: 22577

Joined: Feb. 2006

|

|

Posted on: Dec. 06 2017,7:32 am |

|

|

^^ yeah, that’s been said a lot, over many many years and it’ll continue for many many more years.

As for now?

Attached Image

--------------

Remember boys and girls, Remember boys and girls,

Don’t be a Dick  … …

Or a “Wayne”

|

|

|

|

| Post Number: 289

|

was1

Group: Members

Posts: 1880

Joined: Apr. 2015

|

|

Posted on: Dec. 06 2017,7:48 am |

|

|

I tend to no go by what unions put out. However, all the quotes in it are telling.

Looks to me like Trump just saved all his overseas companies millions. But, like he told Letterman "we need to put them to work too" when discussing his ties and other products are made over seas.

R's have long talked about reducing the debt, reducing the trade deficit, bringing jobs back to the US. 10 months in of them having total control and the opposite on all is happening and they are giddy about it.

|

|

|

|

| Post Number: 290

|

Self-Banished

Group: Members

Posts: 22577

Joined: Feb. 2006

|

|

Posted on: Dec. 06 2017,7:51 am |

|

|

^^ yes, the US tie industry is in ruins

--------------

Remember boys and girls, Remember boys and girls,

Don’t be a Dick  … …

Or a “Wayne”

|

|

|

|

|

|

|