|

|

| Post Number: 81

|

grassman

Group: Members

Posts: 3858

Joined: Mar. 2006

|

|

Posted on: Sep. 11 2013,6:38 am |

|

|

What seems to be lacking on some people's understanding, is that it is pretty much spelled out that the working poor are still the working poor while the huge profits are being absorbed by the top. The top find ways of not paying the same rate of tax as the lower paid workers. This is taking money out of the working capital for the various govt. agencies. These agencies are not going away. Therefore the middle class has to pick up the tab. Got it!

Income gains for 1% break records

WASHINGTON The income gap between the richest 1 percent and the rest of America last year reached the widest point since the Roaring Twenties, an academic study shows.

The top 1 percent of U.S. earners collected 19.3 percent of household income in 2012, their largest share since 1928. Last year, the incomes of the top 1 percent rose nearly 20 percent, compared with a 1 percent increase for the remaining 99 percent.

The share held by the top 10 percent of earners last year reached a record 48.2 percent.

U.S. income inequality has been growing for almost three decades. But it grew again last year, according to an analysis of IRS figures dating to 1913 by economists at the University of California, Berkeley, the Paris School of Economics and Oxford University.

One of the researchers, Emmanuel Saez of the University of California, Berkeley, said the incomes of the richest Americans might have surged last year in part because they cashed in stock holdings to avoid higher capital gains taxes that took effect in January, although he said that such a scenario could only explain part of the disparity.

Saez was careful to point out that the 2012 data is based on projections and subject to revision. But from 2009 to 2012, using established data, the conclusions for the vast majority of Americans are just as dreary .

Saez said that during those years, average real income per family grew a modest 6 percent. "However, the gains were very uneven," he wrote. "Top 1 percent incomes grew by 31.4 percent while bottom 99 percent incomes grew only by 0.4 percent from 2009 to 2012.

"Hence, the top 1 percent captured 95 percent of the income gains in the first three years of the recovery."

The top 10 percent haven't done badly, either. Last year, they captured 48.2 percent of income, up from the previous record, 46.6 percent, in 2011.

"We now have more data to show that workers aren't getting fair share of income, which is strengthening the burgeoning movement of worker protests in fast food, retail and the Occupy Movement," said Tamara Draut, vice president of policy and research at public interest advocacy group Demos. "If you think about the notions of what Americans believe about their country, like the American dream of a broad middle class, this should be a wake-up call that this is not a good path for our democracy to be on."

The top 1 percent of American households had income above $394,000 last year. The top 10 percent had income exceeding $114,000.

The income figures include wages, pension payments, dividends and capital gains from the sale of stocks and other assets. They do not include so-called transfer payments from government programs such as unemployment benefits and Social Security.

--------------

git er done!

|

|

|

|

| Post Number: 82

|

Self-Banished

Group: Members

Posts: 22707

Joined: Feb. 2006

|

|

Posted on: Sep. 11 2013,7:51 am |

|

|

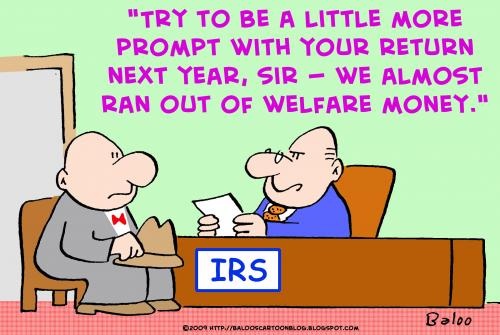

But you see that's just it, our tax code is so screwed up, so complicated that if you have enough $ to hire good accountants you can slide, side-step and work your way around paying large amounts of taxes. Let's simplify our tax code, everyone gets to pay including the bottom feeders that seem to get back more than they pay in.

--------------

Remember boys and girls, Remember boys and girls,

Don’t be a Dick  … …

Or a “Wayne”

|

|

|

|

| Post Number: 83

|

Common Citizen

Group: Members

Posts: 4818

Joined: Jul. 2006

|

|

Posted on: Sep. 12 2013,5:38 pm |

|

|

(grassman @ Sep. 11 2013,6:38 am)

QUOTE What seems to be lacking on some people's understanding, is that it is pretty much spelled out that the working poor are still the working poor while the huge profits are being absorbed by the top. The top find ways of not paying the same rate of tax as the lower paid workers. This is taking money out of the working capital for the various govt. agencies. These agencies are not going away. Therefore the middle class has to pick up the tab. Got it!

Income gains for 1% break records

WASHINGTON The income gap between the richest 1 percent and the rest of America last year reached the widest point since the Roaring Twenties, an academic study shows.

The top 1 percent of U.S. earners collected 19.3 percent of household income in 2012, their largest share since 1928. Last year, the incomes of the top 1 percent rose nearly 20 percent, compared with a 1 percent increase for the remaining 99 percent.

The share held by the top 10 percent of earners last year reached a record 48.2 percent.

U.S. income inequality has been growing for almost three decades. But it grew again last year, according to an analysis of IRS figures dating to 1913 by economists at the University of California, Berkeley, the Paris School of Economics and Oxford University.

One of the researchers, Emmanuel Saez of the University of California, Berkeley, said the incomes of the richest Americans might have surged last year in part because they cashed in stock holdings to avoid higher capital gains taxes that took effect in January, although he said that such a scenario could only explain part of the disparity.

Saez was careful to point out that the 2012 data is based on projections and subject to revision. But from 2009 to 2012, using established data, the conclusions for the vast majority of Americans are just as dreary .

Saez said that during those years, average real income per family grew a modest 6 percent. "However, the gains were very uneven," he wrote. "Top 1 percent incomes grew by 31.4 percent while bottom 99 percent incomes grew only by 0.4 percent from 2009 to 2012.

"Hence, the top 1 percent captured 95 percent of the income gains in the first three years of the recovery."

The top 10 percent haven't done badly, either. Last year, they captured 48.2 percent of income, up from the previous record, 46.6 percent, in 2011.

"We now have more data to show that workers aren't getting fair share of income, which is strengthening the burgeoning movement of worker protests in fast food, retail and the Occupy Movement," said Tamara Draut, vice president of policy and research at public interest advocacy group Demos. "If you think about the notions of what Americans believe about their country, like the American dream of a broad middle class, this should be a wake-up call that this is not a good path for our democracy to be on."

The top 1 percent of American households had income above $394,000 last year. The top 10 percent had income exceeding $114,000.

The income figures include wages, pension payments, dividends and capital gains from the sale of stocks and other assets. They do not include so-called transfer payments from government programs such as unemployment benefits and Social Security.

Americans in 'Poverty' Have TVs, VCRs, Cell Phones, Air Conditioning

American poverty just ain’t what it used to be. A new report from the Census Bureau found that 80.9% of households considered poverty stricken have cell phones along with their landline phones, and 58.2% have computers. 96.1% of those in “poverty” have televisions, and 83% have some sort of DVR.

The percentage owning refrigerators? 97.8%

Gas or electric stoves? 96.6%.

Microwaves? 93.2%

Air conditioning? Over 83%.

Washer? 68.7%

Dryer? 65.3%

People still don’t mind washing dishes, apparently; only 44.9% surveyed had a dishwasher.

|

|

|

|

| Post Number: 84

|

grassman

Group: Members

Posts: 3858

Joined: Mar. 2006

|

|

Posted on: Sep. 13 2013,7:49 am |

|

|

So people still buy these items. What does that have to do with the rising seperation of earnings? Typical smoke screen.

--------------

git er done!

|

|

|

|

| Post Number: 85

|

Common Citizen

Group: Members

Posts: 4818

Joined: Jul. 2006

|

|

Posted on: Sep. 13 2013,8:00 am |

|

|

I kind of took your article as a complaint against rich people and that the rich keep getting richer. People will then naturally begin to feel sorry for the poor and angry with the rich. I took a step back and thought about how we define poor in this day and age and how different it was 100-150 years ago.

|

|

|

|

| Post Number: 86

|

|

|

| Post Number: 87

|

|

|

| Post Number: 88

|

|

|

| Post Number: 89

|

irisheyes

Group: Super Administrators

Posts: 3040

Joined: Oct. 2003

|

|

Posted on: Sep. 14 2013,11:04 pm |

|

|

(Common Citizen @ Sep. 13 2013,8:00 am)

QUOTE I took a step back and thought about how we define poor in this day and age and how different it was 100-150 years ago.

Your point is well taken, people in poverty did not have TV's, VCR's, and air conditioning 100 to 150 years ago.

^I'm just razzing ya, I know the point you're trying to make. But TV's and appliances are not luxuries anymore, old ones cost more to dispose of than they're worth. So you'll see plenty of poor people with a hand-me-down TV, fridge, or dishwasher. Or they rent their home or apartment, in which case the appliances are included.

Granted, poverty in modern America is not near what it is in third world countries. But only the Republicans want to see the poor do worse and the rich do better. For example, Grover Norquist and friends. Which brings me to my next point, courtesy of Self-Banished.

Self-Banished:

QUOTE But you see that's just it, our tax code is so screwed up, so complicated that if you have enough $ to hire good accountants you can slide, side-step and work your way around paying large amounts of taxes. Let's simplify our tax code, everyone gets to pay including the bottom feeders that seem to get back more than they pay in.

Repubs managed to convince you that a less complicated tax code is good, the bad part is that in doing so they'll make it even more regressive than it already is. And you'll pay more in taxes as a result.

Even Lincoln wouldn't have suggested such a regressive tax; his income tax wasn't even flat, it was progressive with the bottom bracket paying nothing.

The middle class already pays a higher rate in taxes than the richest, I don't see how it benefits the economy to make it even more regressive. But Grover Norquest and AM radio have sure convinced a lot of people that it's better to eliminate taxes on corporations, lower them even more for the richest 1%, and raise them for the middle class.

--------------

You know it's going to be a bad day when you cross thread the cap on the toothpaste.

|

|

|

|

| Post Number: 90

|

Self-Banished

Group: Members

Posts: 22707

Joined: Feb. 2006

|

|

Posted on: Sep. 15 2013,5:07 am |

|

|

(irisheyes @ Sep. 14 2013,11:04 pm)

QUOTE

(Common Citizen @ Sep. 13 2013,8:00 am)

QUOTE I took a step back and thought about how we define poor in this day and age and how different it was 100-150 years ago. Your point is well taken, people in poverty did not have TV's, VCR's, and air conditioning 100 to 150 years ago.  ^I'm just razzing ya, I know the point you're trying to make. But TV's and appliances are not luxuries anymore, old ones cost more to dispose of than they're worth. So you'll see plenty of poor people with a hand-me-down TV, fridge, or dishwasher. Or they rent their home or apartment, in which case the appliances are included. Granted, poverty in modern America is not near what it is in third world countries. But only the Republicans want to see the poor do worse and the rich do better. For example, Grover Norquist and friends. Which brings me to my next point, courtesy of Self-Banished. Self-Banished: QUOTE But you see that's just it, our tax code is so screwed up, so complicated that if you have enough $ to hire good accountants you can slide, side-step and work your way around paying large amounts of taxes. Let's simplify our tax code, everyone gets to pay including the bottom feeders that seem to get back more than they pay in. Repubs managed to convince you that a less complicated tax code is good, the bad part is that in doing so they'll make it even more regressive than it already is. And you'll pay more in taxes as a result. Even Lincoln wouldn't have suggested such a regressive tax; his income tax wasn't even flat, it was progressive with the bottom bracket paying nothing.The middle class already pays a higher rate in taxes than the richest, I don't see how it benefits the economy to make it even more regressive. But Grover Norquest and AM radio have sure convinced a lot of people that it's better to eliminate taxes on corporations, lower them even more for the richest 1%, and raise them for the middle class.

Let's take a look at this

http://www.statisticbrain.com/welfare-statistics/

And this one,

http://www.cato.org/publica...ome-tax

Attached Image

--------------

Remember boys and girls, Remember boys and girls,

Don’t be a Dick  … …

Or a “Wayne”

|

|

|

|

|

|

|