|

|

| Post Number: 41

|

|

|

| Post Number: 42

|

Common Citizen

Group: Members

Posts: 4818

Joined: Jul. 2006

|

|

Posted on: Jul. 16 2012,1:15 pm |

|

|

You made the accusation. The burden of proof is on you. You can start by researching what kinds of defferred compensation plans he was a participant in since he first started working. I would assume that would take you back some 40 years.

Please share with all of us so we know how you came to your conclusion.

|

|

|

|

| Post Number: 43

|

MADDOG

Group: Moderator

Posts: 7821

Joined: Aug. 2003

|

|

Posted on: Jul. 16 2012,1:50 pm |

|

|

Makes it a little harder than if you had to research Obama. He first started working three years ago.  Of course his work records would have been sealed. Of course his work records would have been sealed.

--------------

Actually my wife is especially happy when my google check arrives each month. Thanks to douchbags like you, I get paid just for getting you worked up. -Liberal

|

|

|

|

| Post Number: 44

|

Expatriate

Group: Members

Posts: 16954

Joined: Oct. 2004

|

|

Posted on: Jul. 16 2012,3:32 pm |

|

|

(Expatriate @ Jul. 16 2012,11:13 am)

QUOTE

(Common Citizen @ Jul. 13 2012,7:36 pm)

QUOTE Good lord... Anyone with half a brain knows you can roll a tax deffered account from your employer into an IRA upon separation from service. I see nothing has changed here. Nuff said...  Expat: To my knowledge IRS code puts contribution limits on all tax deferred retirement accounts no matter how they originate, so exactly how does a rollover explain the hundred million dollar figure?

QUOTE ·CC Posted on Jul. 16 2012,1:15 pm:

You made the accusation. The burden of proof is on you. You can start by researching what kinds of defferred compensation plans he was a participant in since he first started working. I would assume that would take you back some 40 years.

Please share with all of us so we know how you came to your conclusion.

Romney would have to release his records something he’s refused to do so far...he’s applying for a job working for US I’d like to know more about him!

Why is he so secretive if he’s done no wrong?

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

| Post Number: 45

|

MADDOG

Group: Moderator

Posts: 7821

Joined: Aug. 2003

|

|

Posted on: Jul. 16 2012,3:48 pm |

|

|

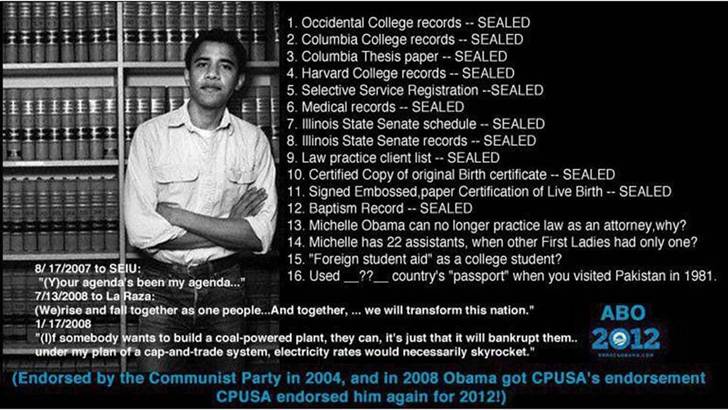

I couldn't agree more.

Attached Image

--------------

Actually my wife is especially happy when my google check arrives each month. Thanks to douchbags like you, I get paid just for getting you worked up. -Liberal

|

|

|

|

| Post Number: 46

|

Common Citizen

Group: Members

Posts: 4818

Joined: Jul. 2006

|

|

Posted on: Jul. 16 2012,7:57 pm |

|

|

(Expatriate @ Jul. 16 2012,3:32 pm)

QUOTE

(Expatriate @ Jul. 16 2012,11:13 am)

QUOTE

(Common Citizen @ Jul. 13 2012,7:36 pm)

QUOTE Good lord... Anyone with half a brain knows you can roll a tax deffered account from your employer into an IRA upon separation from service. I see nothing has changed here. Nuff said...  Expat: To my knowledge IRS code puts contribution limits on all tax deferred retirement accounts no matter how they originate, so exactly how does a rollover explain the hundred million dollar figure? QUOTE ·CC Posted on Jul. 16 2012,1:15 pm:

You made the accusation. The burden of proof is on you. You can start by researching what kinds of defferred compensation plans he was a participant in since he first started working. I would assume that would take you back some 40 years.

Please share with all of us so we know how you came to your conclusion. Romney would have to release his records something he’s refused to do so far...he’s applying for a job working for US I’d like to know more about him! Why is he so secretive if he’s done no wrong?

Why are you making allegations based on assumptions?

|

|

|

|

| Post Number: 47

|

Expatriate

Group: Members

Posts: 16954

Joined: Oct. 2004

|

|

Posted on: Jul. 16 2012,8:23 pm |

|

|

^ Romney will be taxed eventually on the IRA money but I’d like to know how he got that type of money in a IRA, even if it’s a 401k rollover limits on contributions exist 16.500. per year, even if he qualified for a S.E.P. that hundred million dollar figure would take an extreme return rate of return.

On his offshore accounts Switzerland , Bermuda, the Caymans are notorious tax shelters... The less Romney types pay the more working folks like you and me pay...

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

| Post Number: 48

|

Common Citizen

Group: Members

Posts: 4818

Joined: Jul. 2006

|

|

Posted on: Jul. 16 2012,10:46 pm |

|

|

You should take a look at ALL the different kinds of deferred comp plans available for highly compensated employees of corporations.

Defined benefit plans have an annual limit of up to $200k alone.

|

|

|

|

| Post Number: 49

|

blahblahblah

Group: Members

Posts: 76

Joined: May 2011

|

|

Posted on: Jul. 16 2012,11:02 pm |

|

|

(Expatriate @ Jul. 16 2012,8:23 pm)

QUOTE ^ Romney will be taxed eventually on the IRA money but I’d like to know how he got that type of money in a IRA, even if it’s a 401k rollover limits on contributions exist 16.500. per year, even if he qualified for a S.E.P. that hundred million dollar figure would take an extreme return rate of return.

On his offshore accounts Switzerland , Bermuda, the Caymans are notorious tax shelters... The less Romney types pay the more working folks like you and me pay...

Romney was 37 years old when they started Bain Capital, he was a Harvard grad who worked in management consulting prior to starting Bain Capital. It's safe to say he probably didn't start with an IRA/401K balance of $0. Initial returns in the late 80's for private equity and LBO's were significant. Adding longer term private equity returns on top of that, and potential direct investment in Bain itself, it seems possible to me.

Lets say Mitt started with $500,000

From 1985 to 1990 he earned 50% (good years for LBO's)

$500,000 x (1.50)^5 = $3,800,000

Then from 1990 to 2005 he earned the average (index) private equity return of 18%

$3,800,000 x (1.18)^15 =$45,500,000

That's $500,000 (just his initial balance) to $45,500,000 in 20 years. That does not include any additional contributions, and the 18% returns do not include an ownership stake in Bain Capital (which as I understand he could legally own in his self-directed IRA). If he owned Bain Capital in his IRA, given how Bain Capital has grown that return could be very substantial, well in excess of the 18%.

If the return on Bain Capital was an annualized 30%

$500,000 x (1.30)^20 = $95,000,000

Performance Source, page 6 exhibit 3

The good news for you Expat is that it looks like Bain is hiring.

Careers at Bain

|

|

|

|

| Post Number: 50

|

Common Citizen

Group: Members

Posts: 4818

Joined: Jul. 2006

|

|

Posted on: Jul. 17 2012,6:55 am |

|

|

When you combine significant contributions early along with company matching funds in addition to maxing out your IRA contributions, then throw in successful investment choices as well as the compounding of your investment over those years it is easy to see how this can occur.

Consider the rule of 72. It would take an investor 6 years to double his money if the average return was 12%, 4.8 years at 15%, 4 years at 18%, etc...

Bottom line, nothing has been exposed here but the ignorance of the investment options available to all (if not the actual salaries and/or benefits to accumulate an equivalent IRA balance).

No loopholes.

Based on his recent article in the NYTimes, Paul Krugman is a freakin' moron who enjoys dumbing down his reader's.

nuff said...

|

|

|

|

|

|

|