|

|

| Post Number: 61

|

|

|

| Post Number: 62

|

jimhanson

Group: Moderator

Posts: 8491

Joined: Aug. 2003

|

|

Posted on: Aug. 19 2010,10:30 pm |

|

|

(irisheyes @ Aug. 19 2010,5:09 pm)

QUOTE

(jimhanson @ Aug. 17 2010,7:43 pm)

QUOTE The flaw in your theory is that the people that bought luxury homes were WEALTHY. Obviously, they were NOT! If they WERE, they could have paid off the mortgage.

People bought far more house than they could afford, based on the BFM principle--"Bigger Fool than Me"--the idea that they could flip the house for a profit. That worked in an UP market--but not a DOWN market. Just because someone is wealthy doesn't automatically mean they can pay off their house at any moment, especially after the market takes a dive. Many of them followed the same bigger fool than me theory that everyone else did. Or they just decided to give the place up when their house value went too far underwater.

Aren't those the points I just made?

--------------

"If you want to anger a Conservative, tell him a lie. If you want to anger a LIBERAL, tell him the TRUTH!"

|

|

|

|

| Post Number: 63

|

|

|

| Post Number: 64

|

Glad I Left

Group: Members

Posts: 2306

Joined: Aug. 2005

|

|

Posted on: Aug. 20 2010,9:03 pm |

|

|

fixed. I would never do an ARM unless normal interest rates were around 18% or something godawful like that where the only thing they could would be to go down.

--------------

After we screw up health care reform, let's take on the initiative of unscrewing the education system (gov't education)

Tacitus: (c. 56 AD-c. 117) "The more corrupt the state, the more it legislates."

|

|

|

|

| Post Number: 65

|

|

|

| Post Number: 66

|

Santorini

Group: Members

Posts: 2015

Joined: Nov. 2007

|

|

Posted on: Aug. 21 2010,5:03 pm |

|

|

(alcitizens @ Aug. 18 2010,7:29 pm)

QUOTE

(Glad I Left @ Aug. 18 2010,1:18 pm)

QUOTE Why don't we just go with the fact that it is NOT gov't responsibility to make sure everyone has a home. If you cannot afford something, you don't buy it! It really isn't that difficult of a concept.

I don't care if you are D or an R, gov't job is to make sure the lending practices are fair and that someone is not getting screwed by unfair lending practices, it is NOT their damn job to put you in a house.  QUOTE After these laws were passed by the republicans, people could get into a home for less than it cost to get an apartment. I've seen someone get into a $100,000 house for $460 at closing. Thats frikin Nuts..  Kooks create kooky laws and make a killing doing it and frik up the country in the process.. Thank god they put an end to the majority of those laws in 2008..

First of all:

H.R. 3755 (Zero Downpayment Act of 2004)

NEVER BECAME LAW

AND:

American Dream Downpayment Act or ADDI

provided downpayment, closing cost, and rehabilitation assistance to eligible individuals.

The amount of ADDI assistance may not exceed $10,000

Heard of HUD

--------------

"Things turn out best for those who make the best

of the way things turned out." Jack Buck

|

|

|

|

| Post Number: 67

|

alcitizens

Albert Lea

Group: Members

Posts: 3664

Joined: Jul. 2009

|

|

Posted on: Aug. 21 2010,6:43 pm |

|

|

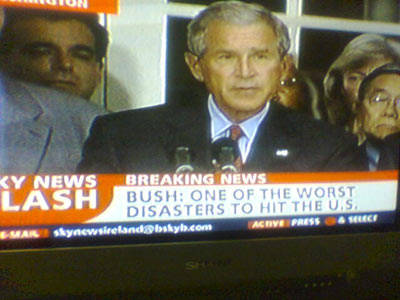

When Bush signed the American Dream Downpayment Act on December 16, 2003, he declared,

One of the biggest hurdles to homeownership is getting money  ... so today I’m honored to be here to sign a law that will help many low-income buyers to overcome that hurdle, and to achieve an important part of the American Dream. ... so today I’m honored to be here to sign a law that will help many low-income buyers to overcome that hurdle, and to achieve an important part of the American Dream.

Attached Image

|

|

|

|

| Post Number: 68

|

Santorini

Group: Members

Posts: 2015

Joined: Nov. 2007

|

|

Posted on: Aug. 22 2010,11:03 am |

|

|

(ICU812 @ Aug. 19 2010,9:31 am)

QUOTE

(MADDOG @ Aug. 19 2010,8:19 am)

QUOTE

(alcitizens @ Aug. 18 2010,9:34 pm)

QUOTE Zero down only works in the car business..  Ask MADDOG how great Zero down is.. No way man. Can you often times get funded with zero down? yes. Should you? Absolutely not. You might as well hand them a shovel too. Should never buy a car you can't afford. A car you can't afford is one you cannot pay cash for. The borrower is slave to the lender. That damn Dave Ramsey.

I LOVE Dave Ramsey

Maybe the Gov't should read his books and take his classes and learn about spending habits.

DEBT-FREE is good

No longer a slave to the banks...my $$$ makes $$$ for me I no longer let the banks make $$$ off my $$$

--------------

"Things turn out best for those who make the best

of the way things turned out." Jack Buck

|

|

|

|

|

|

|