|

|

| Post Number: 11

|

jimhanson

Group: Moderator

Posts: 8491

Joined: Aug. 2003

|

|

Posted on: Feb. 14 2006,4:31 pm |

|

|

| Quote | | So if you would, kind sir, explain to me why interest costs are projected so high? What is the main reason? Could it be the massive budget deficits this administration is running up? |

Happy to oblige--always willing to advance the education of a "recovering liberal".

The answer is found the the text that preceeded the graph. I don't know how to capture a page of Adobe PDF text, so I had to copy in down in longhand, and retype it--but I'd do it just for you!  Here's the link to the site again.http://www.heritage.org/Researc....D=93690 Here's the link to the site again.http://www.heritage.org/Researc....D=93690

| Quote | Total cost of Social Security, Medicare, and Medicaid is projected to leap from 8.4% of GDP in 2005 to 18.9% by 2050.

Federal program spending is projected to reach 27.6% of GDP by 2050, while net interest spending will consume an ADDITIONAL 9% to 46% of GDP (depending on whether massive deficit spending increases interest rates).

Unless Social Security, Medicare, Medicaid are reformed, lawmakers face 3 options:

A. Raise taxes until taxes are 60% ($11,000 per household) higher than today. or

B. Eliminate every federal program EXCEPT Social Security, Medicare, and Medicaid by 2045. or

C. Do nothing, and watch Federal debt expand so much that even a minimal interest rate response would induce a spiral of rising debt and interest rates. |

It is NOT about deficits incurred NOW, it's about the upcoming deficits looming because of unfunded social programs. As published in the Social Security thread, we could have fixed these problems years ago, but by putting our heads in the sand and refusing to acknowledge them, the interest rates on the Federal shortfall on these programs will become more and more severe.

BTW--if anybody out there would care to share their computer knowledge with a Conservative--please PM me and tell me:

A. How do you capture a page or text from Adobe pdf?

B. WHY does Adobe exist?

--------------

"If you want to anger a Conservative, tell him a lie. If you want to anger a LIBERAL, tell him the TRUTH!"

|

|

|

|

| Post Number: 12

|

|

|

| Post Number: 13

|

Scurvy Dog

Group: Members

Posts: 825

Joined: Jul. 2004

|

|

Posted on: Feb. 15 2006,12:37 pm |

|

|

| Quote (jimhanson @ Feb. 14 2006,4:31pm) | BTW--if anybody out there would care to share their computer knowledge with a Conservative--please PM me and tell me:

A. How do you capture a page or text from Adobe pdf?

B. WHY does Adobe exist?   |

Always glad to help a fellow conservative.

I simply highlight the text using the text tool (letter T in the toolbar), copy and paste. I am using Adobe Acrobat. I am not sure if this works using Distiller. It is possible for the author to "protect" PDF documents to prevent copying or printing. That may be the case in some of the PDFs you view online.

To answer your second question, I'm not sure WHY Adobe exists, but their existence is justified in their awesome publishing capabilities. I use Acrobat, Photoshop, Illustrator and InDesign every day.

|

|

|

|

| Post Number: 14

|

Expatriate

Group: Members

Posts: 16799

Joined: Oct. 2004

|

|

Posted on: Feb. 19 2006,8:59 pm |

|

|

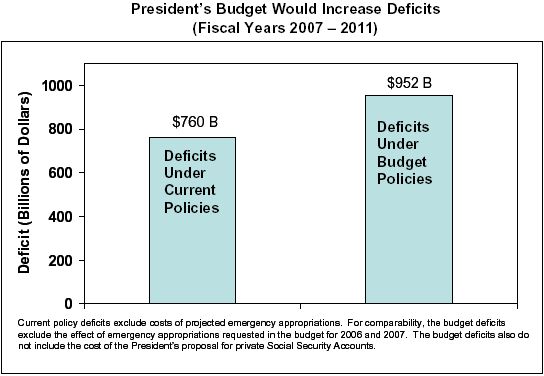

The Administration’s budget would increase the deficit over both the short run and the long run. Fiscal reasonability and fairness in shared sacrifice responsibility for the debt is lacking, this is a reverse Robin Hood plan..

The Bush Administration is proposing sharp cuts in many domestic programs, alongside an array of costly new tax breaks. The tax cuts would favor the most well-off, while the program cuts would primarily affect low- and middle-income Americans.

Attached Image

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

| Post Number: 15

|

Botto 82

Group: Members

Posts: 6293

Joined: Jan. 2005

|

|

Posted on: Feb. 20 2006,12:18 am |

|

|

| Quote (Scurvy Dog @ Feb. 15 2006,12:37pm) | | To answer your second question, I'm not sure WHY Adobe exists, but their existence is justified in their awesome publishing capabilities. I use Acrobat, Photoshop, Illustrator and InDesign every day. |

PageMaker sucks. QuarkXpress is better. All designed for Macs first, PC versions as an afterthought.

--------------

Dear future generations: Please accept our apologies. We were rolling drunk on petroleum.

- Kurt Vonnegut

|

|

|

|

| Post Number: 16

|

Botto 82

Group: Members

Posts: 6293

Joined: Jan. 2005

|

|

Posted on: Feb. 20 2006,12:23 am |

|

|

| Quote (Expatriate @ Feb. 19 2006,8:59pm) | The Administration’s budget would increase the deficit over both the short run and the long run. Fiscal reasonability and fairness in shared sacrifice responsibility for the debt is lacking, this is a reverse Robin Hood plan..

The Bush Administration is proposing sharp cuts in many domestic programs, alongside an array of costly new tax breaks. The tax cuts would favor the most well-off, while the program cuts would primarily affect low- and middle-income Americans. |

Fattening the rich is okay. Poor people are at fault for their own fiscal circumstances.

Bring on the soylent green!

--------------

Dear future generations: Please accept our apologies. We were rolling drunk on petroleum.

- Kurt Vonnegut

|

|

|

|

| Post Number: 17

|

jimhanson

Group: Moderator

Posts: 8491

Joined: Aug. 2003

|

|

Posted on: Feb. 20 2006,4:54 pm |

|

|

We've been over this before--the fallacy of "tax cuts are only for the rich". I got out the employee Federal and State income tax witholding tables.

The fact is, that a family of 4 doesn't even have tax deducted from their paycheck until they reach $22,800--and that doesn't even take into account "Earned Income" ("Negative Income Tax") credit.

Compare that with the liberal State of Minnesota, where that same family starts paying taxes at $18,720. In fact, Minnesota takes MORE MONEY THAN THE FEDERAL GOVERNMENT IN TAXES UNTIL THE EARNER MAKES $28,080 for that family of 4.

It appears that Minnesota could use some of that "tax cut for the rich" to help its poorest taxpayers--but then, that wouldn't fit the libbie rhetoric!

--------------

"If you want to anger a Conservative, tell him a lie. If you want to anger a LIBERAL, tell him the TRUTH!"

|

|

|

|

| Post Number: 18

|

Expatriate

Group: Members

Posts: 16799

Joined: Oct. 2004

|

|

Posted on: Feb. 20 2006,9:16 pm |

|

|

you talk about peanuts, the feed them cake attitude of the Bush Administration...

the tax breaks for big business coupled with

capital gains and dividend tax cuts make it clear that high-income households & corporations have and will BENEFIT THE MOST......

Bush dosn't hate the working class, he just loves the wealthy...

[quote]

"This is an impressive crowd - the haves and the have-mores. Some people call you the elites; I call you my base."

~George W. Bush, New York, October 20, 2000

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

| Post Number: 19

|

jimhanson

Group: Moderator

Posts: 8491

Joined: Aug. 2003

|

|

Posted on: Feb. 21 2006,9:31 am |

|

|

Tell us about the tax breaks for "Big Business" proposed and enacted under Bush?

Dividend tax cuts? Do you think it is right that Corporations pay taxes on earnings, then when they give it to their shareholders, it is taxed AGAIN? One of the precepts of our (admittedly flawed and convoluted) tax code is that you should only be taxed ONCE on income. Dividends and death taxes tax you TWICE. WHY is that a good thing?

Don't give us the "THE "WEALTHY" SHOULD PAY MORE" argument. The biggest investors in the market are the institutional investors--that's Universities, Pension Funds, Union Funds, etc. That's a BROAD CROSS SECTION of the economy--including every working stiff with a pension, 401, or mutual fund. And you think these people should PUT MORE MONEY DOWN THE GOVERNMENT RAT HOLE?

Of course, this is from the same party that thinks it is a GOOD thing to put money in Social Security, that will give you 2% return on investment--IF you live long enough to collect it--IF they don't change the rules on it (as they have over 40 times), IF there is any money left in the bankrupt system. The only certainty--if you die early, your heirs will get NOTHING except a $256 burial allowance, and a small monthly stipend until the kids turn 18. All your money will have gone to pay government administrative expenses.

Attached Image

--------------

"If you want to anger a Conservative, tell him a lie. If you want to anger a LIBERAL, tell him the TRUTH!"

|

|

|

|

| Post Number: 20

|

Expatriate

Group: Members

Posts: 16799

Joined: Oct. 2004

|

|

Posted on: Feb. 21 2006,10:21 pm |

|

|

Those in the working class with stock held in retirement accounts, such as 401(k)s and IRAs differ, capital gains and dividend income accruing inside these retirement accounts is not subject to taxation, and thus would not receive a tax benefit from the reduction in the tax rates on capital gains and dividend income...

Only 17 percent of households in the bottom 60 percent of the income spectrum own stock in taxable accounts. In contrast, 73 percent of the households in the top 10 percent of the income spectrum own stock in taxable accounts. Among those at the very top of the income spectrum - the top one percent - 84 percent own stock in taxable accounts.

Further, among those households that own taxable stock, the average holding is much larger for those at the top of the income spectrum than for those with more modest means. For households in the bottom 60 percent of the population that have any taxable stock, the average value of the holding is about $52,000 (in 2001 dollars). The average value is nearly $2 million for those in the top one percent of households.

Because taxable stock holdings are both smaller and less common for the bottom 60 percent of households, this group owns only 9 percent of all taxable stock. The top 10 percent owns 70 percent of all taxable stock. The top one percent owns 29 percent of all taxable stock.

Over half - 54 percent - of all capital gains and dividend income flows to the 0.2 percent of households with annual incomes over $1 million. More than three-quarters - 78 percent - of this income goes to those households with income over $200,000, which account for about 3 percent of all households.

In contrast, only 11 percent of capital gains and dividend income goes to the 86 percent of households with incomes of less than $100,000. Only 4 percent of this income flows to the 64 percent of households that have income of less than $50,000...

"This is an impressive crowd - the haves and the have-mores. Some people call you the elites; I call you my base."

~George W. Bush, New York, October 20, 2000

--------------

History is no more than the lies agreed upon by the victors.

~NAPOLEON BONAPARTE

|

|

|

|

|

|

|