|

|

| Post Number: 1

|

cwolff

Group: Members

Posts: 265

Joined: Aug. 2003

|

|

Posted on: Mar. 08 2004,9:26 am |

|

|

| Quote | The same thing is going on with the Federal budget and future entitlements. I have heard that future promised entitlements for social security, medicare, medicade, federal retirement pensions and insurance, survivor benefits, and ect.. total around 65-70 trillion dollars, but we have no chance in he!! to pay for it. (quote by CWolff)

| Quote | | the Social Security scare is nothing but smoke and mirrors done so that there will be support to move money out of the Social Security Fund into the stock market. You have to look deeper than the 10 second news bite from your favorite talking head and see that the scare is not as real as they make it seem. (quote by Cpu_slave) |

|

Some people are in denial about the real problem staring us right in the face!

Yesterdays Star Tribune had two stories in two different sections of the newspaper about the problem.

1st story: The Star Tribune stated that the shortfall for Social Security and Medicare will rise to $44.8 trillion this year.

2nd story: The Star Tribune stated that "according to Laurence J. Kotlikoff of Boston University, the present value of the gap between promised outlays and projected revenues is $51 trillion - more than four times the nation's GDP. Today the household wealth of Americans - the value of their houses, 401(k)s, cars, refrigerators, toasters, socks, everything - is about $42 trillion."

What are we going to have to do about this real problem?

|

|

|

|

| Post Number: 2

|

Frustrated

Group: Members

Posts: 226

Joined: Feb. 2004

|

|

Posted on: Mar. 08 2004,9:53 am |

|

|

What we have to do is make sure we are individually prepared to live without social security when we retire.

|

|

|

|

| Post Number: 3

|

cpu_slave

Group: Members

Posts: 297

Joined: Aug. 2003

|

|

Posted on: Mar. 08 2004,1:17 pm |

|

|

Published March 5, 2004 in the New York Times

| Quote | Social Security Scares

By PAUL KRUGMAN

The annual report of the Social Security system's trustees reveals a system in pretty good financial shape. In fact, it would take only modest injections of money to maintain that system's current benefit levels for at least the next 75 years. Other reports, however, appear to portray a system in deep financial trouble. For example, a 2002 Treasury study, described on Tuesday in The New York Times, claims that Social Security and Medicare are $44 trillion in the red. What's the truth?

Here's a hint: while even right-wing politicians insist in public that they want to save Social Security, the ideologues shaping their views are itching for an excuse to dismantle the system. So you have to read alarming reports generated by people who work at ideologically driven institutions a list that now, alas, includes the U.S. Treasury with great care.

First, two words "and Medicare" make a huge difference. According to the Treasury study, only 16 percent of that $44 trillion shortfall comes from Social Security. Second, the supposed shortfall in both programs comes mainly from projections about the distant future; 62 percent of the combined shortfall comes after 2077.

So does the Treasury report show a looming Social Security crisis? No.

Social Security's problem, such as it is, is a matter of demography: as the population ages, the number of retirees will rise faster than the number of workers. As a result, benefit costs will rise by about 2 percent of G.D.P. over the next 30 years, and creep up slowly thereafter. By comparison, making the Bush tax cuts permanent would reduce revenue by at least 2.5 percent of G.D.P., starting now. That combined with the fact that Social Security, unlike the rest of the federal government, is currently running a surplus is why the Bush tax cuts are a much bigger problem for the nation's fiscal future than the Social Security shortfall.

Medicare, though often lumped in with Social Security, is a different program facing different problems. The projected rise in Medicare expenses is mainly driven not by demography, but by the rising cost of medical care, which in turn mainly reflects medical progress, which allows doctors to treat a wider range of conditions.

If this trend continues which is by no means certain when we are considering the very long run we may face a real long-term dilemma that involves all medical care, not just care for retirees, and is as much moral as economic. It may eventually be the case that providing all Americans with the full advantages of modern medicine will force the government to raise much more money than it now does. Yet not providing that care will mean watching poor and middle-class Americans die early or suffer a greatly reduced quality of life because they can't afford full medical treatment.

But this dilemma will be there regardless of what we do to Social Security. It's not even clear that we should try to resolve the dilemma now. I'm all for taking the long view; when the administration makes budget projections for only five years to hide known costs just a few years further out, that's an outrage. By all means, let's plan ahead. But let's set some limits. When people issue ominous warnings about the cost of Medicare after 2077, my question is, Why should fiscal decisions today reflect the possible cost of providing generations not yet born with medical treatments not yet invented?

The biggest risk now facing Social Security is political. Will those who hate the system use scare tactics and fuzzy math to bring it down?

After Alan Greenspan's call for cuts in Social Security benefits, Republican members of Congress declared that the answer is to create private retirement accounts. It's amazing that they are still peddling this snake oil; it's even more amazing that journalists continue to let them get away with it. Yesterday in The Wall Street Journal, a writer judiciously declared that "personal accounts alone won't cure Social Security's ills." I guess that's true; similarly, eating doughnuts alone won't cause you to lose weight. Why is it so hard to say clearly that privatization would worsen, not improve, Social Security's finances?

Should we consider modest reforms that reduce the expenses or widen the revenue base of Social Security? Sure. But beware of those who claim that we must destroy the system in order to save it.

|

--------------

An age is called Dark, not because the light fails to shine, but because people refuse to see it.-James A. Michener

Two things are infinite: the universe and human stupidity; and I'm not sure about the universe.-Albert Einstein

Wise men learn more from fools than fools from wise men.- Marcus Cato

|

|

|

|

| Post Number: 4

|

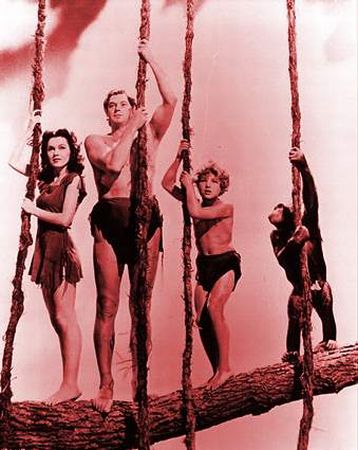

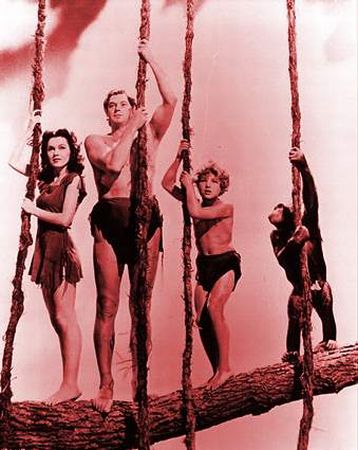

MrTarzan

Group: Members

Posts: 564

Joined: Feb. 2004

|

|

Posted on: Mar. 08 2004,3:56 pm |

|

|

Unfortunately so many of us are in the system and invested so much, to scrap it now would hurt me. I am hoping, not counting on, that extra bit to make old age better for me.

--------------

Be not simply good, be good for something-Henry David Thoreau

|

|

|

|

| Post Number: 5

|

sick of it

Group: Members

Posts: 17

Joined: Sep. 2003

|

|

Posted on: Mar. 08 2004,4:17 pm |

|

|

so if it is true that all of this money is going to be used up when my kids should start collecting why should we be forced to pay into it now? at least if I could hold onto that money and even put it into a savings account or bonds or something I will have a littlebit for when I need it. why pay all of this moneyjust to not get it back?

|

|

|

|

| Post Number: 6

|

cwolff

Group: Members

Posts: 265

Joined: Aug. 2003

|

|

Posted on: Mar. 08 2004,10:23 pm |

|

|

Who is going to be funding social security when the 77 million baby boomers retire?

|

|

|

|

| Post Number: 7

|

MrTarzan

Group: Members

Posts: 564

Joined: Feb. 2004

|

|

Posted on: Mar. 10 2004,6:05 pm |

|

|

Bill Gates?

--------------

Be not simply good, be good for something-Henry David Thoreau

|

|

|

|

|

|

|